Introduction

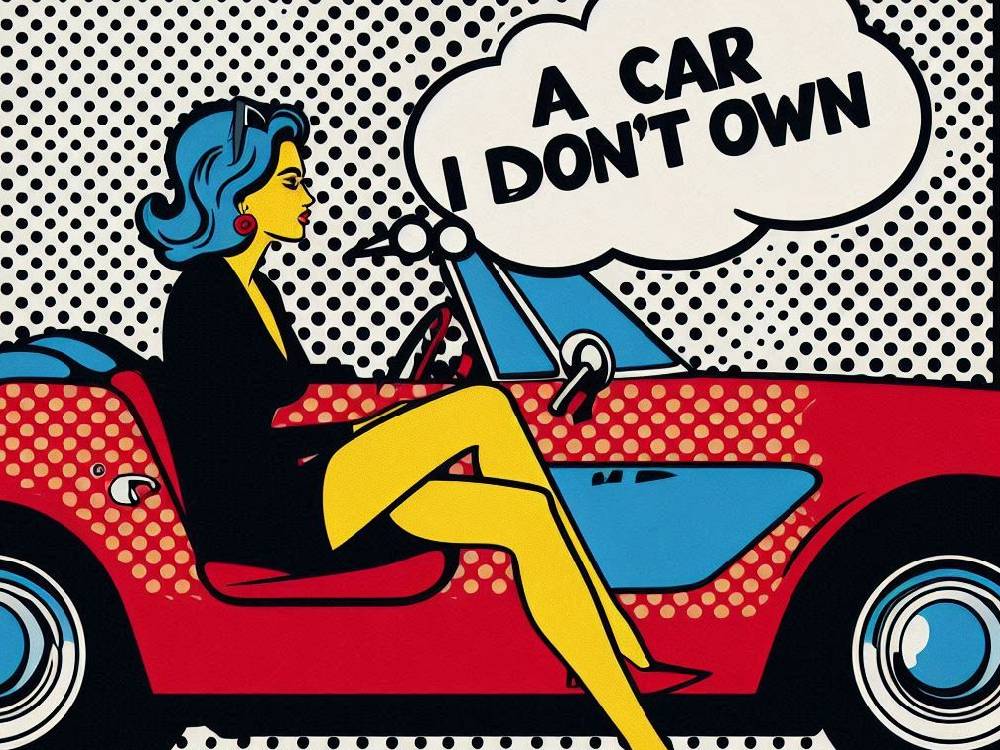

Need to insure a car that doesn’t belong to you?

It might seem complicated.

But don’t worry.

It’s a common situation.

You could be borrowing a friend’s vehicle.

Or perhaps you’re using a relative’s car temporarily.

Either way, there are several insurance options to keep you covered.

In this article, we’ll explore your choices.

You’ll learn about stand-alone policies, named driver insurance, and temporary cover.

We’ll also look at the legal aspects, like avoiding insurance fraud.

Here’s a quick overview:

- Stand-alone policies for long-term cover

- Named driver insurance for sharing a vehicle

- Temporary insurance for short-term needs

Can I Insure A Car I Don’t Own?

Yes, you can insure a car you don’t own.

But it depends on the circumstances.

You don’t have to be the registered owner or keeper to insure a car.

However, some insurers impose restrictions.

In many cases, you can only be insured if the car’s owner is a close family member or spouse.

So, if you’re borrowing a car from a friend or a colleague, you need to find an insurance company that allows this.

When applying for insurance, transparency is essential.

Failing to disclose key details can result in a denied claim.

Even worse?

It could be considered fraud.

But here’s the thing – not all insurers are flexible.

Many companies only insure the registered keeper of the vehicle.

This makes it essential to shop around for a policy that fits your needs.

Types Of Insurance For Non-Owners

There are several ways to insure a car you don’t own.

Each option has its own pros and cons.

Let’s take a closer look:

1. Stand-Alone Insurance Policy

A stand-alone policy is perfect if you’re the main driver of a car you don’t own.

When applying, you’ll need to inform the insurer that you’re not the car’s owner or registered keeper.

Why does this matter?

Not all insurers offer this type of coverage.

Even those that do may only cover you if the owner is a spouse, parent, or employer.

The downside?

It’s often the most expensive option.

However, if you’ll be driving the car frequently, a stand-alone policy is the most reliable choice.

2. Named Driver Insurance

Named driver insurance is another popular option.

It’s often the cheapest way to get insured on a car you don’t own.

Here’s how it works:

You’re added to the existing policy of the car’s owner as an additional driver.

Be upfront with your insurer about who the main driver is.

Why does this matter?

If you’re dishonest, you risk committing insurance fraud.

This is known as “fronting,” where the named driver is actually the main driver.

It’s illegal and comes with serious penalties.

3. Temporary Car Insurance

Temporary car insurance offers flexible short-term coverage.

Unlike stand-alone or named driver policies, temporary insurance is ideal for brief occasions when you need to drive a car that isn’t yours.

Cover can range from just a few hours to several months.

This option is particularly useful for short-term borrowing.

Think about road trips or borrowing a car for a weekend.

However, temporary policies tend to be more expensive per day than annual policies.

Keep this in mind if you need long-term coverage.

Insure: Important Considerations

Transparency is key.

Always provide accurate details to the insurer.

This includes information on who owns the car and how often you’ll be driving it.

Being dishonest could void your policy.

Worse, it may lead to legal consequences for fraud.

One last thing:

Before applying for a new policy, check your existing insurance.

Some comprehensive policies include third-party cover for borrowing another vehicle.

Always read your policy documents or speak to your insurer to confirm what’s covered.

Differences Between A Car’s Owner And Registered Keeper

Now, let’s talk about the difference between a car’s owner and its registered keeper.

At first glance, they might seem like the same thing.

However, they serve very different roles.

The owner is the legal holder of the car, meaning they paid for it or received it as a gift.

On the other hand, the registered keeper is the person listed on the DVLA registration certificate, responsible for things like taxing and insuring the vehicle.

For example, let’s say a company owns the car.

The employee driving it could be the registered keeper, handling the day-to-day responsibilities.

So why does this matter when getting insurance?

Well, many insurers only issue coverage to the registered keeper.

Therefore, if you plan to insure a car you don’t legally own, this might limit your options.

It’s crucial to understand this distinction before diving into the insurance process.

Otherwise, you might find yourself searching for the right policy longer than expected.

Can I Insure A Car That’s Already Insured?

So, what happens if the car you want to insure is already covered by someone else?

In certain cases, yes, you can insure a car that already has an active policy.

However, the process isn’t always simple.

In fact, adding an additional policy could complicate things.

For short-term use, your best bet might be a temporary car insurance policy.

This allows you to drive the car without cancelling the existing coverage.

But keep in mind, temporary insurance is typically more expensive on a daily basis than a long-term policy.

Alternatively, you might find it cheaper to add yourself to the existing policy as a named driver.

Why is this better?

Well, it’s usually the most affordable way to share insurance coverage on a car.

Just be sure to clarify with the insurer how often you’ll be driving, as this is typically meant for occasional use.

If you plan on using the car regularly, you may need to explore other options.

Conclusion

To sum up, insuring a car you don’t own is not only possible but also fairly straightforward if you know your options.

First, consider your needs.

If you’re the primary driver, a stand-alone policy may be the best solution.

On the other hand, if you’re borrowing the car temporarily, temporary car insurance or becoming a named driver might be more cost-effective.

But remember, transparency is key.

It’s crucial to provide accurate information to your insurer.

If you misrepresent your situation, you could void your policy or even face charges of insurance fraud.

Finding the right insurance for a car you don’t own may take a little time, but with some research and honesty, you can find the best solution.

For further reading, check out these helpful articles: